Funding your company is simple difficult. True you can easily receives a commission if you have a conventional business. It will be hard press to obtain the banks to provide you with financing for the affiliate, network, network marketing, or online marketing business.

If you’re a licensed professional like a realtor, insurance professional, or certified financial planners best of luck on traditional funding sources.

This informative guide provides you with 21.5 methods to funding your home based business. Searching to boost between $500-$10,000? Then to you. You might want to offer top-tier products and obtain compensated greater commissions. But you do not have the cash to purchase your company to provide top-tier services. I give 21.5 methods to fund your company.

Listed here are 21.5 methods to fund your company:

Quick Funding Sources

1. Personal Savings: The easiest method to fund your home based business. You’re investing your individual savings right into a cash flowing business that provides you with mega returns. You have to think such as this to achieve success. You aren’t expending savings you’re investing it.

2. The Three F’s: Family, Buddies, and Fools. It’s tricky borrowing money from family and buddies. Particularly if you have past beginning and quitting companies. For those who have lent before and unsuccessful to repay it you’re up a creek. Then then are fools. There’s someone available who provides you with money. I’ve elevated over 200 1000 dollars from buddies, family, and fools.

Make sure to draft an itemized agreement saying whenever you will pay back the money. Provide a high rate of interest therefore the person won’t seem like a “Fool” when they’re providing you with their cash.

3. Charge Cards: Make use of your charge cards to obtain began. This really is easy when you really need under $300 to begin your company and becomes difficult when you wish to market top-tier items that pay greater commissions.

Make use of your charge cards or another person. This is when the three F’s are available in again. I began my opportunity, gave my pal 5% equity, coupled with her get business charge cards. Then i lent $5000 in my online marketing business. It required me 18 several weeks to pay for her back however she will get her vehicle note compensated each month along with a nice dividend check in the finish of the season.

4. Temporary or Pay day Loans: For those who have employment you might want to try short-term or pay-day loans. You are able to borrow as much as $2500 with a few of these institutions. This really is high-risk and make certain you’re in your home based business for that lengthy haul. Their rates of interest are atrocious.

5. Personal Credit lines: make use of your personal credit lines out of your bank. I favor to make use of lending institutions since they’re a bit more lenient and provide better rates. And so they have favorable repayment terms.

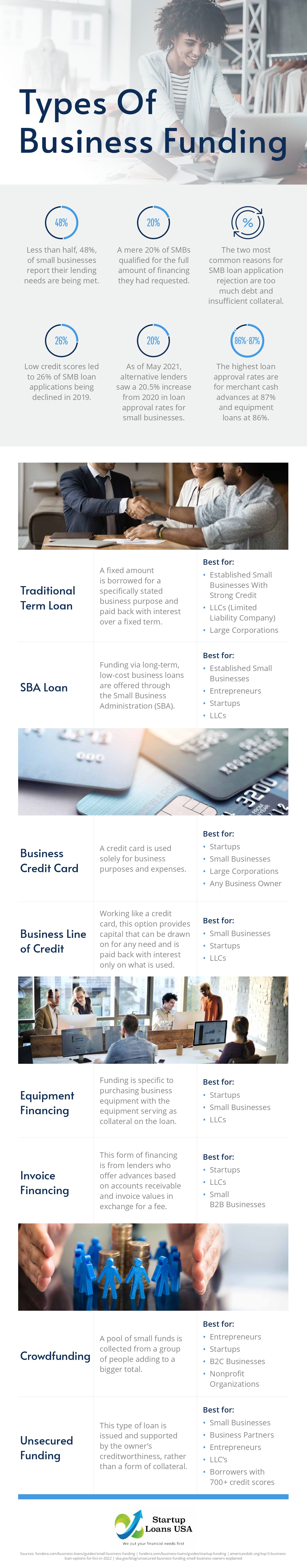

Infographic provided by Startup Loans USA, a business startup loans company